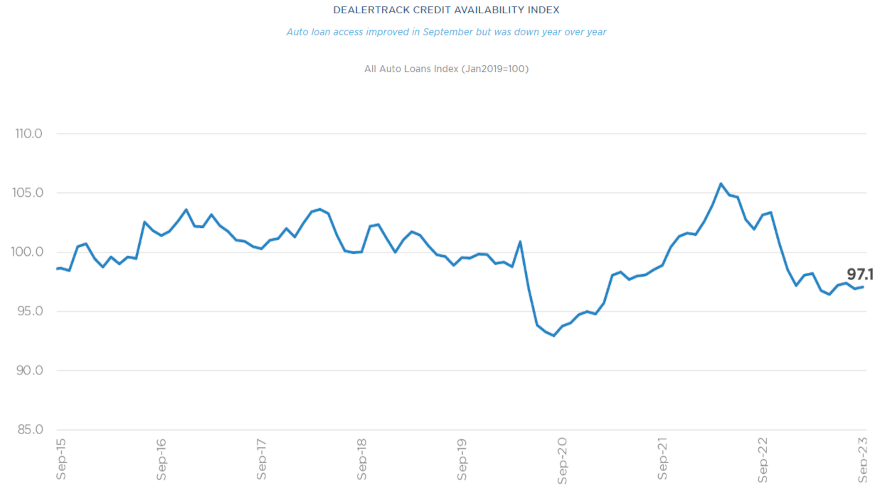

Even with slight improvement in September, auto credit availability remains tight

Chart courtesy of Cox Automotive.

The Dealertrack Credit Availability Index for September showed some slight improvement, as Cox Automotive reported on Tuesday that credit access was made more accessible.

But compared to this time last year or before the pandemic, it’s still a challenge in some cases to get contracts bought.

The index posted an increase of 0.2% in September to come in at 97.1. Analysts explained this reading means that access is still tighter by 5.9% year-over-year.

And compared to February 2020, Cox Automotive pointed out that access is tighter by 2.1%.

“Movement in credit availability factors was mixed in September. Approval rates increased, subprime share increased, negative equity share increased, down payments declined, and those moves improved consumer credit access,” Cox Automotive said in its analysis that accompanied the latest index reading. “However, average terms lengthened, yield spreads widened, and those moves hurt consumer credit access.”

Analysts noted the average yield spread on auto finance in September widened by 7 basis points, so rates consumers saw on their installment contracts were less attractive in September relative to bond yields.

Cox Automotive indicated the average auto finance rate increased by 25 basis points in September compared to August, while the five-year U.S. Treasury increased by 17 basis points, resulting in a narrower average observed yield spread.

The index update also mentioned the approval rate decreased by 5 basis points in September, softening by 0.7 percentage points year-over-year.

Analysts added the subprime share increased to 11.1% in September from 11.0% in August but ticked 0.6 percentage points lower year-over-year.

Cox Automotive went on to note the share of contracts with terms greater than 72 months was flat in September but was off year-over-year by 2.1 percentage points.

“Credit availability loosened in August across most lender types; banks tightened. Captives loosened the most. On a year-over-year basis, credit access to all lenders was tighter, with credit unions tightening the most,” Cox Automotive said.

Each Dealertrack Auto Credit Index tracks shifts in approval rates, subprime share, yield spreads and contract details, including term length, negative equity, and down payments.

The index is baselined to January 2019 to show how credit access shifts over time.

View The Latest Edition

View The Latest Edition