2 reports detail intensifying search for affordable car insurance

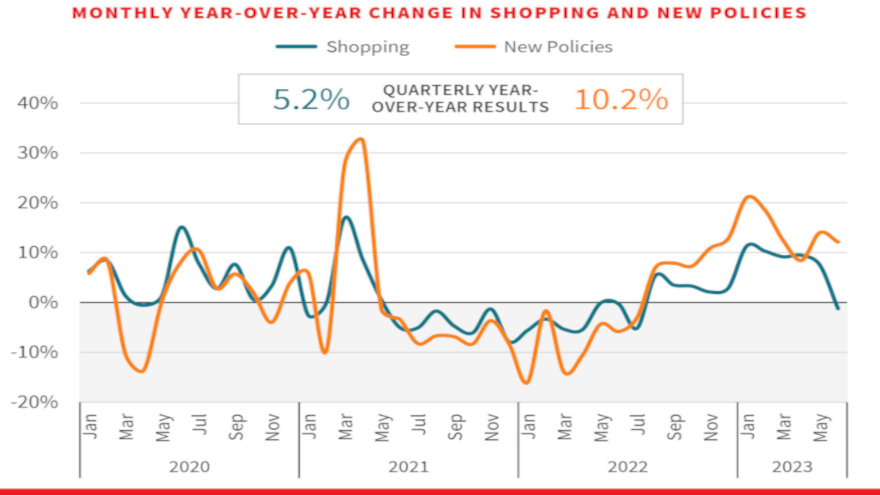

Chart courtesy of LexisNexis Risk Solutions.

Separate reports from TransUnion and LexisNexis Risk Solutions indicated consumers are shopping for new car insurance nowadays with similar intensity as they are for a different vehicle.

As dealerships continue to offer insurance solutions in their F&I offices, findings from TransUnion’s latest quarterly Insurance Personal Lines Trends and Perspectives Report showed auto insurance shopping rates rose 12% in the second quarter, compared to the same time in 2022.

While vehicle sales played a role in this increase, TransUnion noted the search for lower insurance premiums was the primary driver, as the Consumer Price Index for motor vehicle insurance rose 17% year-over-year in June.

“There was a drop in shopping activity among riskier consumers in Q2 2022, partly due to insurer’s reduced marketing spend; however, we saw a rebound in activity from that segment in Q2 2023,” said Stothard Deal, vice president of strategic planning for TransUnion’s insurance business. “Lower risk consumers have been consistently shopping at higher rates for the past 12 months.”

TransUnion determined car insurance shopping rates for consumers with credit scores at 500 and below jumped 25% year-over-year. Consumers with credit scores between 501 and 700 generated an 11% lift in car insurance shopping activity, while individuals with the highest credit scores posted a 16% increase in insurance shopping action.

The TransUnion report found homeowners are also shopping for lower rates, with property insurance shopping among that group rising 13% in Q2 2023 compared to the same time last year. However, the shopping rate was down 7% compared to Q1 2023, most likely due to increasing interest rates and stubbornly high home prices.

TransUnion explained the situation presents potential challenges and opportunities for insurers with younger Gen Z and millennial customers. As those groups are kept priced out of homeownership, TransUnion said some individuals may opt to live in regions more prone to natural disasters, which has significant implications for insurance losses.

Others may simply choose to continue renting, which opens an opportunity for insurers to modernize their renter’s insurance offerings. In addition, this group will likely need a different approach for marketing efforts, according to TransUnion.

“It’s time for insurers to start thinking about how to most effectively engage with their upcoming Gen Z customers,” Deal said in a news release. “We know they are more likely to learn about new products and services from social media and appreciate receiving personalized offers.”

LexisNexis notices rising shopping activity, too

Meanwhile, the latest edition of the LexisNexis Risk Solutions Insurance Demand Meter indicated the quarterly year-over-year U.S. auto insurance shopping growth came in at 5.2% in Q2 2023, as consumers continue to react to widespread rate increases by auto insurers in the face of an ever-hardening market.

Although year-over-year shopping growth remains high, LexisNexis Risk Solutions said new business volumes began to outpace shopping last quarter, signaling that the consumers who are shopping are finding policies that suit their individual needs.

Quarterly year-over-year new policy growth – or the rate at which consumers either switched or purchased new coverage – was strong, rising by 10.2%, according to LexisNexis Risk Solutions.

“Profitability is still a challenge for many insurers, driven in large part by a continued rise in claims severity across the market associated with rising costs to repair damaged vehicles,” said Adam Pichon, senior vice president of auto insurance and claims at LexisNexis Risk Solutions.

“As a result, most carriers are being much more discerning in their underwriting processes and cutting back on marketing spend, but motivated shoppers still sought better cost savings, and switched their policies in record numbers in May and June,” Pichon continued.

LexisNexis Risk Solutions explained many insurance carriers have responded conservatively to the current hard market.

Experts said lower-cost policies may be difficult to find, but savvy shoppers are still finding them, leading to very high new policy growth numbers in recent quarters. But new policy growth is only part of the consumer story.

LexisNexis Risk Solutions also pointed out increased claims severities have continued to challenge the U.S. auto insurance market, registering six consecutive quarters of at least 5% growth.

Fueled by labor and parts shortages, experts said the cost to repair – or replace – vehicles is increasing, and more than a quarter of collision events from 2022 (27%) were total losses, which has added more expense pressure.

LexisNexis Risk Solutions acknowledged that insurers are reacting accordingly, not only by taking rate and reducing marketing spend, but some large carriers have even pulled out of higher-risk markets altogether.

“It’s a tough situation. Inflationary pressure on repair costs is creating more total losses on top of the added costs to those vehicles that can be repaired – and our data continues to suggest that consumers are shopping near claims events,” said Chris Rice, associate vice president of insurance strategic business intelligence at LexisNexis Risk Solutions. “When you combine these macroeconomic factors with claims and injury severities soaring, a lot of insurers have taken a step back to reassess how they will manage risk across their books of business for the foreseeable future.”

View The Latest Edition

View The Latest Edition